Aug 19, 2025

Basics

What Is an Exchange-Traded Fund (ETF)? Beginner’s Guide

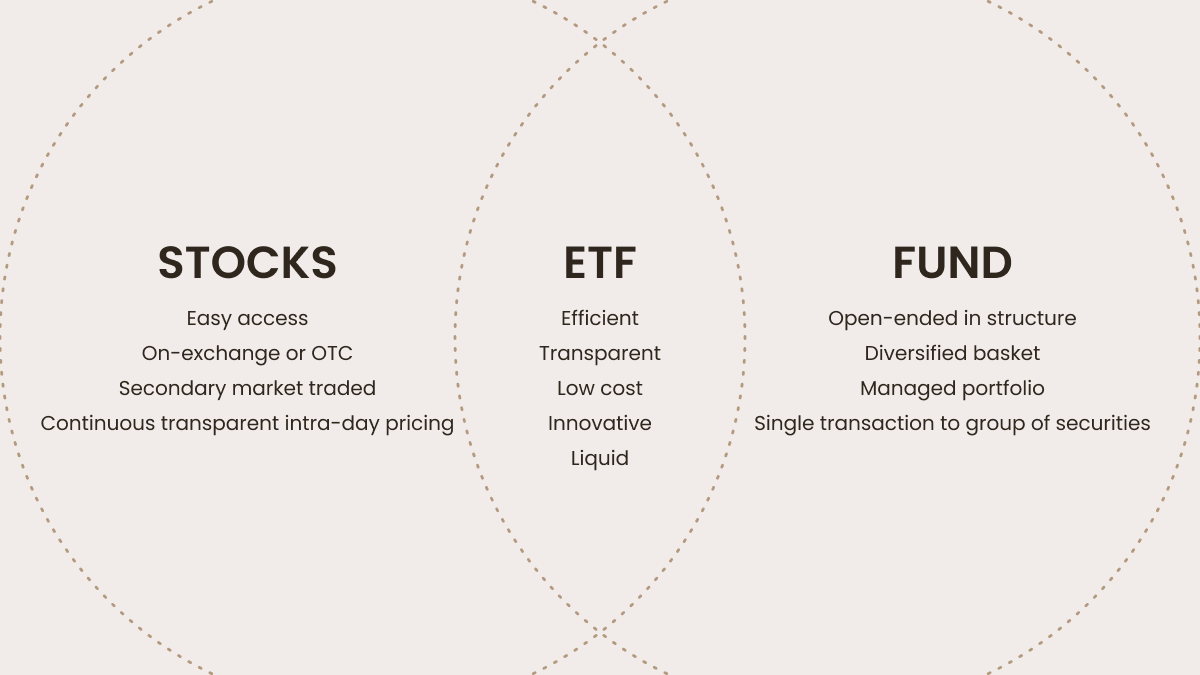

An exchange-traded fund (ETF) is an investment fund traded on stock exchanges that combines multiple assets and can be bought or sold just like a single stock.

ETFs are popular due to their diversification, low costs, and ease of trading. An ETF lets investors put their money into several assets at once through a single investment.

An ETF is made up of specific assets like oil, gold, or even coffee. However, most ETFs typically consist of a collection of stocks of various companies. These can be stocks of the largest companies in a single country, a specific economic sector, or from different regions.

For example, you can have:

A tech ETF that includes stocks from top global technology companies.

A green energy ETF that consists of stocks from leading renewable energy businesses.

Buying into an ETF makes the owner of a tiny piece of each of the assets in it. It’s a variety pack — a ready-made assortment in one affordable package.

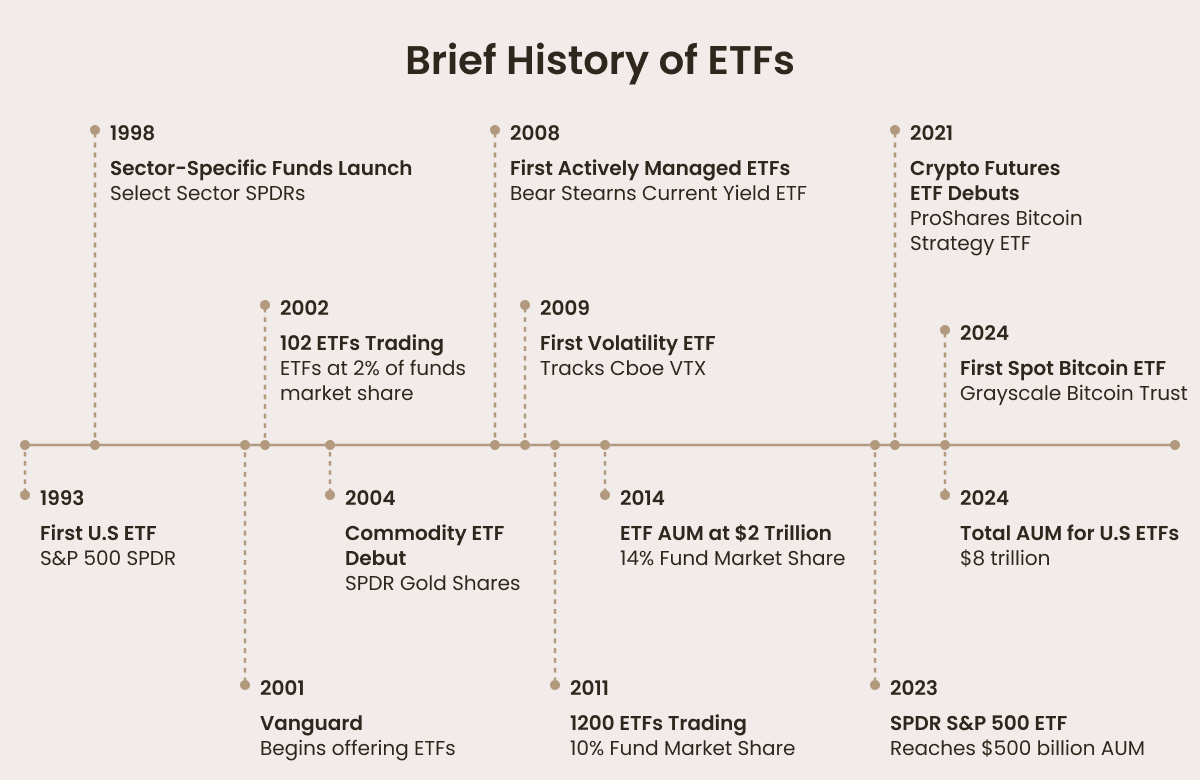

History of ETFs

ETFs were initially conceived in the 1980s by an AMEX exec named Nathan Most as a way of combining indexes with the stock trading style. The first ETF was launched on the Toronto Stock Exchange in 1990. In spite of poopooing by the trading community, whereof many influential representatives were skeptical about turning indexes into objects of intraday trading, in 1993 the SPDR S&P 500 ETF (SPY), developed by State Street Global Advisors, appeared in the US. It is still one of the world’s most heavily traded ETFs today.

Through the 1990s and early 2000s, ETFs underwent major growth and ended up changing our whole view of trading. Fixed-income ETFs appeared in 2002, and commodity ETFs like the SPDR Gold Trust (GLD) in 2004.

By 2021, there were almost 7000 different ETFs out there, and that market was worth over $8 trillion. You can ETF everything under the sun — from equities, to real estate.

How ETFs work

If you buy into an ETF, you don’t actually own the assets in it. You’re only buying shares of the fund itself. That does not necessarily prevent you from receiving dividends from those assets, though. The proportion of your ownership is your investment, divided by the number of assets in the fund.

The price of an ETF is sometimes different from the value of the underlying assets on both short- and long-term bases — the former because of perennial market activity, the latter due to fund expenses.ETFs are often thought of as cost-effective, partly because they have lower fees than other kinds of funds.

Key features:

Market pricing is continually updated throughout the day, unlike mutual funds, which are priced once daily after markets close.

Most ETFs in the US have an open-ended structure, meaning there’s no limit to the number of investors who can buy in.

ETFs are regulated. They must be registered with the Securities and Exchange Commission (SEC) and often operate under the Investment Company Act of 1940.

Steps to trading ETFs

Asset selection: the ETF provider chooses a basket of assets, such as the consumer staples companies in the VDC example, and organizes them into a fund with a unique ticker symbol.

Share buying: investors buy shares in the ETF.

Stock trading: the shares of the ETF are traded on stock exchanges just like stocks.

Types of ETFs

There’s a whole galaxy of ETFs out there, and they’re all different. There are different ways to categorize them, too: according to asset type, investment approach, and so on.

Here are five of the most common types of ETFs:

Market index ETFs: Track the performance of specific stock exchanges or markets.

Sector ETFs: Focused on particular industries like tech, healthcare, or energy.

Bond ETFs: Follow the performance of bond markets.

Commodity ETFs: Invest in commodities like gold, oil, or agricultural products.

Thematic ETFs: Track themes like renewable energy or artificial intelligence.

In addition to these, there are ETFs that are specifically focused on socially responsibly investing or volatility and risk reduction.

Pros and cons of ETFs

Pros:

Invest in a variety of stocks from different industries with one ETF.

Reduce risk by spreading your investment across many assets.

Save money with low fees and fewer broker commissions.

Start with a smaller deposit instead of buying expensive individual stocks.

Buy and sell easily just like stocks for more flexibility.

Earn dividends from ETFs that hold stocks.

Choose ETFs focused on specific industries or trends you're interested in.

Cons:

Market risk.

Tracking errors.

Management fees - these are generally low.

Risks of investing in ETFs

Market risk. If the market or sector the ETF tracks goes down, the value of the ETF will also drop, no matter how well it’s managed.

Broken ETFs. These occur when something goes wrong with the markets they track. This can cause prices to disconnect from the underlying assets.

Confusing labels. The thousands of ETFs to choose from, with some looking similar but holding different types of investments, can lead to big differences in performance.

Complex investments. Some ETFs focus on complicated assets like commodities or currencies. These can be harder to understand and may not behave the way you expect.

The ETF may shut down. If the fund fails to attract enough investors and shuts down, you might face unexpected tax costs and fees.

How to invest in ETFs

Choose a broker. To buy or sell ETFs you will need access to a broker account.

Select the right ETF. Passive index funds are usually the best choice for beginners. They are cheaper than actively managed funds.

Buy ETF shares.

Monitor performance. But be cool about it. ETFs are low-maintenance investments. It's best to let them grow over time without frequent checking, which may lead to emotional trading, and in any case is not good for your nerves.

Most popular ETFs for investors

SPDR S&P 500 ETF (SPY): One of the most popular ETFs, providing exposure to the S&P 500 index.

Vanguard Total Stock Market ETF (VTI): Provides exposure to the entire U.S. stock market.

Invesco QQQ ETF (QQQ): Tracks the NASDAQ-100, focusing on technology and growth stocks.

SPDR Dow Jones Industrial Average (DJIA): An ETF that represents the 30 stocks of the Dow Jones Industrial Average.

Tax implications of ETFs

If you sell an ETF, you’ll have to pay taxes on what you made from the sale. If your ETF is the kind that contains stocks that pay dividends, those dividends are also taxed.

Some ETFs are long-term investments, and those may qualify for long-term capital gains tax rates, which are lower.

How to choose the right ETF

What do you want to do?

Are you in this to get a broad chunk of the market? Invest in a specific sector? Or maybe you’re looking for commodities? The first thing you need to do is decide what you’re looking for.How much is going to cost you?

Costs can really vary between different ETFs, even if they’re tracking the same index. You need to figure out how much you’re going to be paying and figure out if that’s the most profitable thing you can do, given your investment plans.Is the ETF liquid enough?

You don’t want to be stuck with an ETF you can’t sell when you need your money. If it’s not liquid enough, it might cost you too much to get rid of, which can really cut into your profits in a major way.Is the ETF diverse enough? And how well does it perform?

You’ve got to look into whether the ETF meets the performance standard in its category, and also make sure it’s nice and diverse.Active or passive management?

Do you want fund managers to be making manual decisions in your ETF all the time, or for it to just track a trustworthy index?

Open an FBS account

By registering, you accept FBS Customer Agreement conditions and FBS Privacy Policy and assume all risks inherent with trading operations on the world financial markets.