The Reserve Bank of New Zealand (RBNZ) kept its Official Cash Rate (OCR) steady at 3.25% on July 9, 2025, following six consecutive cuts since August 2024. The pause came after a cumulative 225 basis points of easing from a mid-2024 peak of 5.5%. The May adjustment reduced the OCR by 25 bps from 3.5% to 3.25%. Still, July's decision marked a turning point, as policymakers signaled the need for greater clarity on inflation, global trade risks—particularly US tariffs—and the domestic recovery.

Inflation remains within the 1–3% target band, though it sits at the upper end. The central bank expects price pressures to peak in mid-2025 and ease toward 2% by early 2026. Labor market data has softened, with unemployment rising to 5.2%, the highest in nearly five years. While GDP has posted modest growth over two straight quarters, momentum remains fragile against global slowdown and trade uncertainty.

Leadership changes have further underscored the cautious tone: Governor Adrian Orr stepped down, leaving Christian Hawkesby as acting Governor during this delicate policy phase.

Technical Outlook

Market expectations are firmly tilted toward renewed easing. A Reuters poll conducted between August 11 and 14 indicated an 88% probability of a 25 bps cut at the upcoming August 20 meeting, which would bring the OCR to 3.00%. Forward guidance suggests the potential for another cut to 2.75% in early 2026, aligning with projections from the May Monetary Policy Statement that saw the OCR fall near 2.92% by Q4 2025 and 2.85% by Q1 2026.

Current OCR & Recent Rates

- The Official Cash Rate (OCR) currently stands at 3.25%, as confirmed by the RBNZ's official site on July 9, 2025. This marked the central bank's first pause after six consecutive rate cuts since August 2024.

- Before this:

- May 2025: Cut by 25 bps from 3.5% to 3.25%.

- The OCR has declined from a COVID-era high of 5.5% in mid-2024 to its current level—a total reduction of approximately 225 basis points.

Why the Pause?

- The RBNZ opted to hold at 3.25% in July, signaling the need for more clarity on inflation, global trade (especially US tariffs), and the domestic recovery.

- Inflation remains within the bank's 1–3% target range, though currently toward the upper end.

- The RBNZ expects inflation to peak in mid-2025 and return closer to 2% by early 2026.

What's Next? Expectation of a Rate Cut

- A Reuters poll (Aug 11–14, 2025) shows an 88% probability of a 25 bps cut to 3.00% at the August 20 monetary policy meeting, driven by weakening labor data and easing inflation metrics.

- Forecasts expect the RBNZ to lower the OCR to 3.00% and possibly 2.75% in early 2026. Median economist forecasts point to one more cut this year and another potentially in Q1 2026.

- The May Monetary Policy Statement projected the OCR to fall to approximately 2.92% by Q4 2025 and further to 2.85% in Q1 2026, implying deeper easing ahead.

- An analyst's discretionary assessment suggests the RBNZ is comfortable with continued easing but cautious, wanting to confirm the impact of prior cuts before committing to more.

Broader Economic Context

- Unemployment has risen to 5.2%, the highest in nearly five years—another reason supporting imminent rate cuts.

- Though GDP has recovered modestly, growing for two consecutive quarters, momentum remains fragile amid global slowdown and trade uncertainty.

- The central bank's leadership changes—Adrian Orr's resignation and Christian Hawkesby serving as acting Governor—add to the sense of cautious monetary policy navigation.

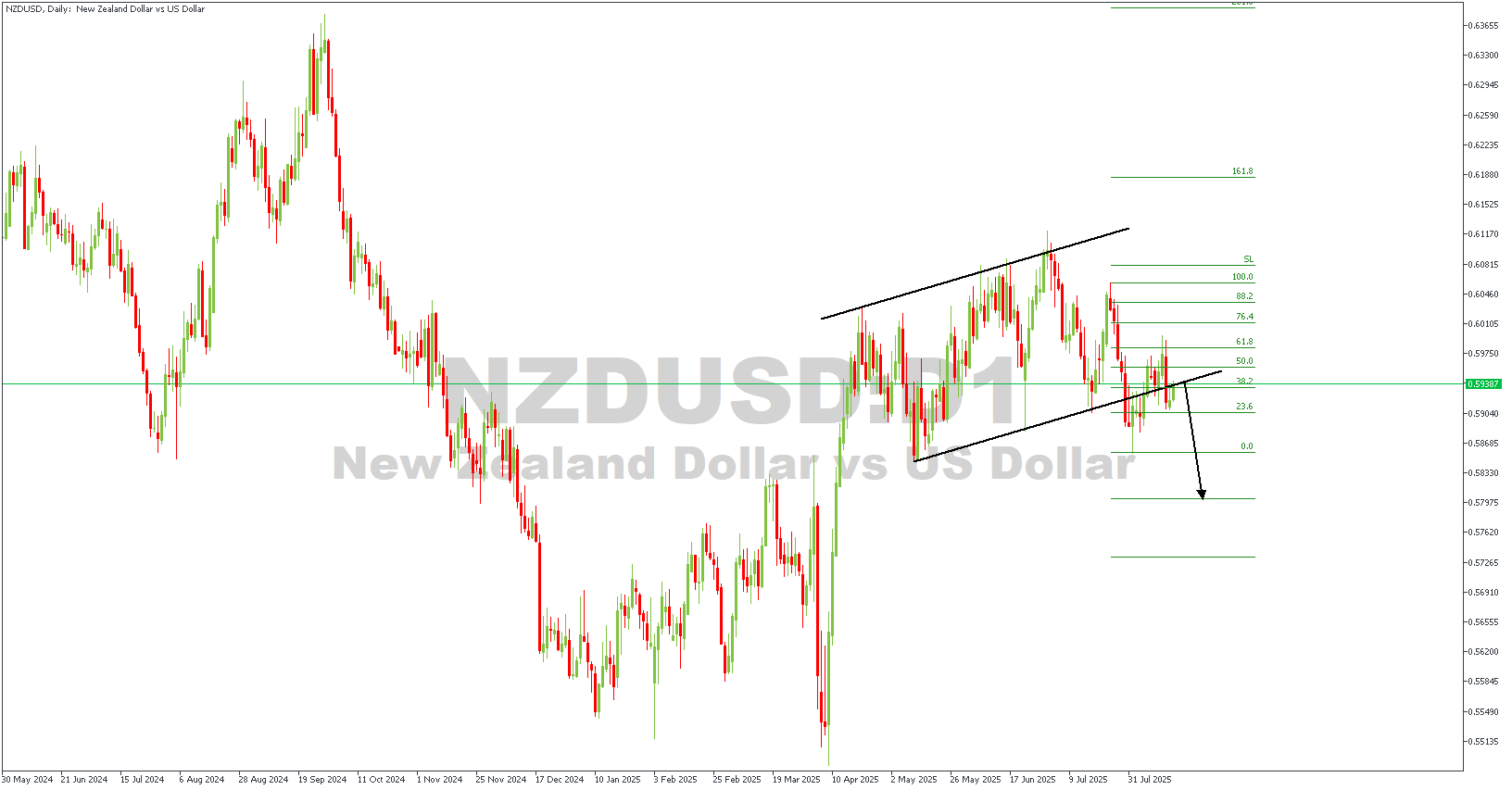

NZDUSD D1 Timeframe

On this NZDUSD Daily chart:

Price was trading within a rising channel, producing higher highs and lows. However, the bullish momentum faded as sellers stepped in, leading to a breakdown below the channel support trendline.

The structure break aligns with the 61.8% Fibonacci retracement, where the price failed to sustain its bullish push. This rejection triggered a bearish impulse that now puts the pair under pressure.

Currently, price is hovering around the 38.2% retracement level, consolidating after the channel breakdown. The Fibonacci levels highlight potential continuation targets on the downside, with the 0% level near 0.5870 as the immediate bearish objective.

Key confluences strengthening the bearish outlook:

- The broken rising channel acts as resistance.

- Fibonacci rejection from the golden zone (61.8%).

- Bearish momentum candles are forming after the breakdown.

This setup suggests a bearish continuation scenario, with the black arrow pointing to a move lower toward the next demand zone.

Direction: Bearish

Target- 0.50043

Invalidation- 0.60016

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.